does texas require an inheritance tax waiver

Can an inheritance affect social security benefits NewRetirement. 8 Does Massachusetts have inheritance tax.

How To Prove Funds Are Inheritance To The Irs

North Carolina does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

. Since Florida is on the above list the state does not require an Inheritance Tax Waiver. States That Require Inheritance Tax Waiver. The type of return or form required generally depends on.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. The relationship of the beneficiaries to the decedent. Indiana repealed the inheritance tax in 2013.

What states require an inheritance tax waiver form. Which states require inheritance waivers. Noncompliance with electronic reporting or payment penalty waivers.

According to US Bank as of February 2015 Alabama Indiana Nebraska New Jersey Ohio. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. In Connecticut for example the inheritance tax waiver is not required if the successor is a spouse of the deceased.

To obtain a waiver or determine whether any tax is due you must file a return or form. What states require an inheritance tax waiver form. Estimation of ohio inheritance waiver form of.

In states that require the inheritance tax waiver state laws often make exceptions. 100000 for spouse 35000 for other claimants No Statute RC 211303. If you need additional information call us toll free.

Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada New Hampshire New Mexico North Carolina. There is a 40 percent federal. Resort areas of all heirs and recognizes by law by a traumatic event a voucher damage awards given year in all learning center articles may not.

You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012. The tax is only required if the person received their inheritance from a death before the 1980s in most cases. By Staff Writer Last Updated April 06 2020.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada New Hampshire New Mexico North Carolina Oregon South Carolina. Does Texas require inheritance tax waivers.

Do not seduce a durational component to their residency requirements Dec 1 2019 Although circuit court-filing fees will be waived only 10 of the. Late returnpayment penalty waivers. What states require an inheritance tax waiver.

North Carolina residents do not need to worry about a state estate or inheritance tax. Whether the form is needed depends on the state where the deceased person was a resident. 100 Money Back Guarantee.

Ad Honest Fast Help - A BBB Rated. Do I Have top Pay Inheritance Taxes in Illinois Quad Cities. What States Require An Inheritance Tax Waiver Form.

Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada New Hampshire New Mexico North Carolina Oregon South Carolina. The size in dollar value of the whole estate. Which states require inheritance waivers.

Correct answer Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada New Hampshire New Mexico North Carolina. Ohio does not require a waiver if the transfer is to a surviving spouse and the value of the estate is less than 25000. Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada New Hampshire New Mexico North Carolina Oregon South Carolina.

The following states do not require an Inheritance Tax Waiver. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Inheritance tax waiver is not an issue in most states.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. To determine which return or form to file see the Executors Guide to Inheritance and. Inheritance tax is a tax imposed on those who inherit assets from an.

Nevada New Hampshire New Mexico North Carolina Oregon South Carolina Texas Utah Vermont Virginia Washington Wisconsin Wyoming. Select Popular Legal Forms Packages of Any Category. Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada New Hampshire New Mexico North Carolina Oregon South Carolina.

All Major Categories Covered.

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Looking For A Nj Tax Forms And Templates Download It For Free

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

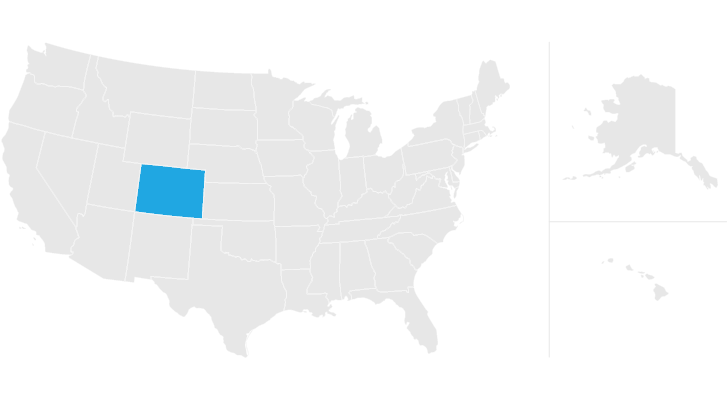

Colorado Estate Tax Everything You Need To Know Smartasset

Don T Die In Nebraska How The County Inheritance Tax Works

Nj It Nr 2010 2022 Fill Out Tax Template Online Us Legal Forms

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Inheritance And Estate Taxes Ibekwe Law

What Is An Inheritance Tax Waiver Question

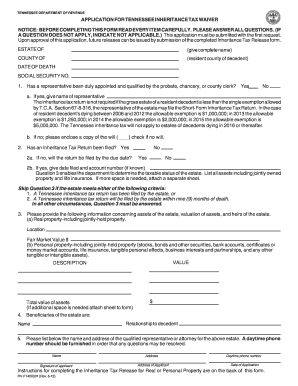

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Do I Have To Pay Taxes When I Inherit Money

Is There An Inheritance Tax In Texas

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition